Published Thu, Jun 4 20206:00 PM EDT

Updated 2 hours agoFred Imbert@foimbert

watch now

VIDEO04:23

U.S. economy added 2.5 million jobs in May—Four experts on what the recovery could look like

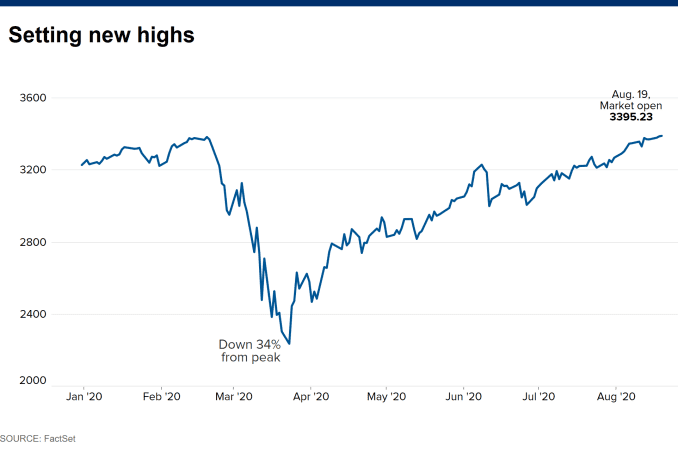

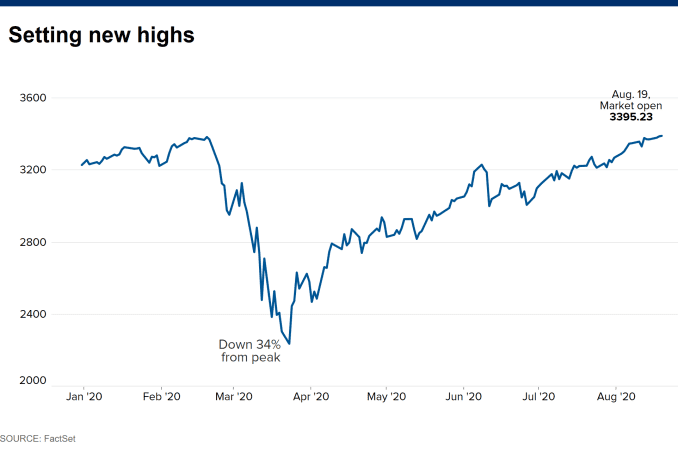

Stocks rallied on Friday after an unexpected surge in U.S. jobs raised hope that the economy is starting to recover from the coronavirus pandemic.

The Nasdaq Composite became the first of the three major averages to climb back to an all-time high, advancing 2.0%, or 198.27 points, to 9,814.08 on Friday and touching an intraday record of 9,845.69. After tumbling as much as 25% earlier this year, the tech-heavy index is now 9.3% higher for 2020.

The Dow Jones Industrial Average jumped 829.16 points, or 3.1%, to 27,110.98. The S&P 500 rose 2.6%, or 81.58 points, to 3,193.93.

Friday’s rally put the S&P 500 down just 1.1% for 2020. At one point this year, the broader market index was down 30.3%. The Dow was only down 5.0% year to date after dropping as much as 34.6% in 2020.

“We’re back,” CNBC’s Jim Cramer said on “Squawk Box.” “I think there were a lot of people who felt that the layoffs would be permanent and it’s obvious that there’s so much demand that people have to bring people back.”

The Dow was up 6.8% for the week, while the S&P 500 gained 4.9% and the Nasdaq Composite was up 3.4%.

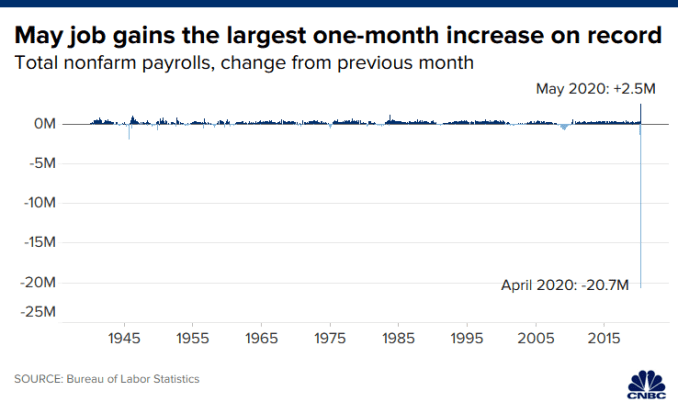

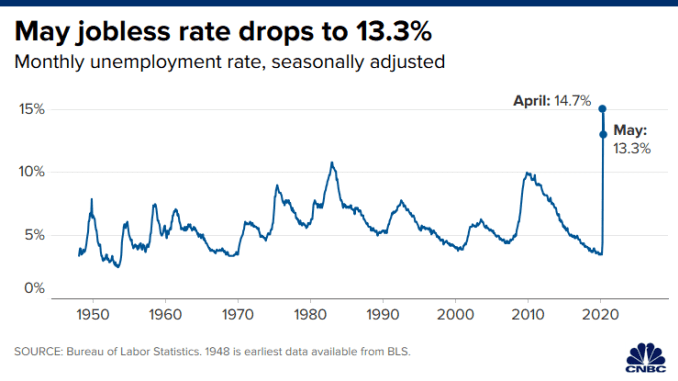

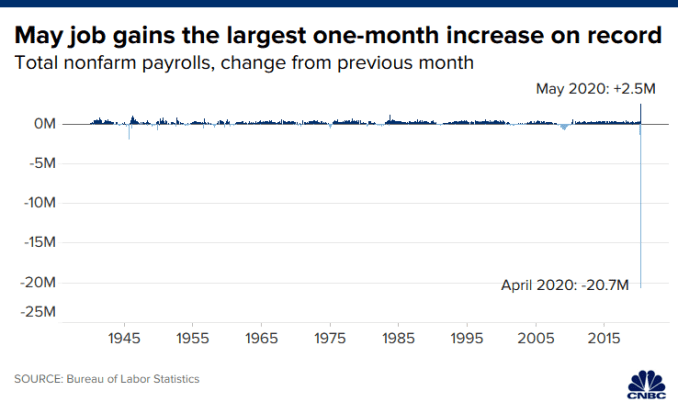

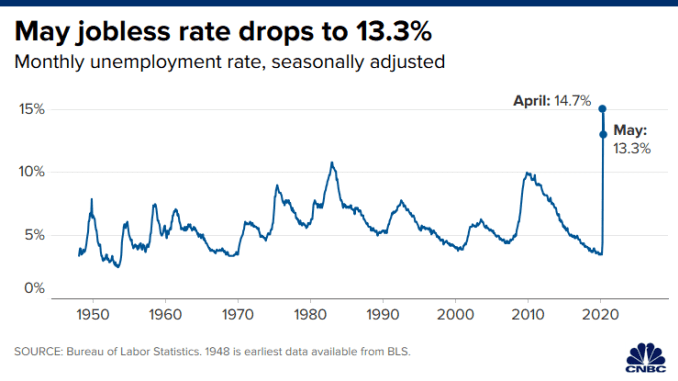

U.S. employers added a shocking 2.5 million jobs last month — the largest gain on record — while the unemployment rate slid to 13.3%,

watch now

VIDEO04:23

U.S. economy added 2.5 million jobs in May—Four experts on what the recovery could look like

Stocks rallied on Friday after an unexpected surge in U.S. jobs raised hope that the economy is starting to recover from the coronavirus pandemic.

The Nasdaq Composite became the first of the three major averages to climb back to an all-time high, advancing 2.0%, or 198.27 points, to 9,814.08 on Friday and touching an intraday record of 9,845.69. After tumbling as much as 25% earlier this year, the tech-heavy index is now 9.3% higher for 2020.

The Dow Jones Industrial Average jumped 829.16 points, or 3.1%, to 27,110.98. The S&P 500 rose 2.6%, or 81.58 points, to 3,193.93.

Friday’s rally put the S&P 500 down just 1.1% for 2020. At one point this year, the broader market index was down 30.3%. The Dow was only down 5.0% year to date after dropping as much as 34.6% in 2020.

“We’re back,” CNBC’s Jim Cramer said on “Squawk Box.” “I think there were a lot of people who felt that the layoffs would be permanent and it’s obvious that there’s so much demand that people have to bring people back.”

The Dow was up 6.8% for the week, while the S&P 500 gained 4.9% and the Nasdaq Composite was up 3.4%.

U.S. employers added a shocking 2.5 million jobs last month — the largest gain on record — while the unemployment rate slid to 13.3%,

the Labor Department said Friday.

Economists polled by Dow Jones expected a drop of more than 8 million jobs and the unemployment rate to nearly reach 20%, which would have been the highest since the 1930s.

“The unemployment rate was solid; the participation rate was higher. This checks all the boxes for a solid report,” said Drew Matus, chief market strategist at MetLife Investment Management. “So even though this was coming off a horrendous report the previous month, there’s nothing that screams this is some sort of error that can be ignored. If anything, it suggests we should be looking for more good news next month.”

The report boosted confidence of a swift economic recovery among traders, leading them into stocks that would benefit the most from a broad reopening.

“We’re having an unbelievable day,” said JJ Kinahan, chief market strategist at TD Ameritrade. “The one thing I’m still cautious on is this incredible optimism trade is being driven without any earnings yet to support it.”

Shares of airlines jumped, adding to their big gains this week, as the industry added more summer flights. American Airlines jumped 11.1% Friday, while United Airlines shares gained 8.5%. Cruise-line operators such as Norwegian Cruise Line and Carnival both advanced more than 14% while Royal Caribbean gained 20.3%.

Mall operator Simon Property gained 15.4%. Kohl’s and Nordstrom advanced 11% and 6%, respectively.

Bank stocks, which have been decimated during the pandemic as lending activity and margins dried up, soared as the jobs report suggested a quick bounce back for the economy. JPMorgan Chase, Citigroup, Wells Fargo and Bank of America all rose at least 4%.

Friday’s gains put the S&P 500 up more than 45% from a March 23 intraday low and less than 6% from its Feb. 19 record.

“The unemployment rate was solid; the participation rate was higher. This checks all the boxes for a solid report,” said Drew Matus, chief market strategist at MetLife Investment Management. “So even though this was coming off a horrendous report the previous month, there’s nothing that screams this is some sort of error that can be ignored. If anything, it suggests we should be looking for more good news next month.”

The report boosted confidence of a swift economic recovery among traders, leading them into stocks that would benefit the most from a broad reopening.

“We’re having an unbelievable day,” said JJ Kinahan, chief market strategist at TD Ameritrade. “The one thing I’m still cautious on is this incredible optimism trade is being driven without any earnings yet to support it.”

Shares of airlines jumped, adding to their big gains this week, as the industry added more summer flights. American Airlines jumped 11.1% Friday, while United Airlines shares gained 8.5%. Cruise-line operators such as Norwegian Cruise Line and Carnival both advanced more than 14% while Royal Caribbean gained 20.3%.

Mall operator Simon Property gained 15.4%. Kohl’s and Nordstrom advanced 11% and 6%, respectively.

Bank stocks, which have been decimated during the pandemic as lending activity and margins dried up, soared as the jobs report suggested a quick bounce back for the economy. JPMorgan Chase, Citigroup, Wells Fargo and Bank of America all rose at least 4%.

Friday’s gains put the S&P 500 up more than 45% from a March 23 intraday low and less than 6% from its Feb. 19 record.

No comments:

Post a Comment